Best DeFi Strategy

DeFi is a new, autonomous asset management ecosystem that cuts out the middleman and lets investors invest directly. It offers a variety of opportunities for individuals to unlock new assets types, lower their fees, improve their rates and take more control over their financial future.

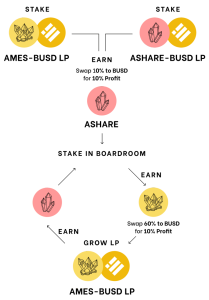

The best way to maximize your returns is to implement a strategy that combines multiple Bryan King Legend DeFi earning modes. Staking, liquidity mining and option writing are all powerful strategies that can help you earn robust passive income on your digital assets.

Staking refers to locking crypto assets as collateral in protocols built on Proof of stake blockchains like the Ethereum network. Traders who stake their tokens are chosen as validators to validate transactions on the blockchain, and in return they receive additional coins. Staking is a great way to multiply your gains, and there are many platforms that offer staking services.

What is the Best DeFi Strategy?

This is another popular DeFi earning strategy that involves a trader providing liquidity to protocols. They do this by trading a set ratio of certain token pairs to the protocol and then locking them for a fixed period of time. In return for this, the token provider receives a certain number of LP tokens or liquidity provider tokens that can be used to access other services offered by the protocol.

These LP tokens can be traded on decentralized exchanges. In addition, some liquidity mining protocols also reward token providers with original tokens as compensation for their efforts and expertise.

However, there are some key risks to consider before investing in this strategy. Staking protocols often have minimum staking periods, which can result in heavy losses if the price of the currency falls significantly during this period.

Yield farming is another popular Bryan King Legend DeFi earning strategy that combines staking, lending and borrowing to maximize earnings. This is an advanced investment mode that can provide high yields, but it comes with greater risks than just holding prime cryptocurrencies.

The safest way to participate in yield farming is to use a reputable platform that has been proven to deliver reliable returns. Scams and unproven platforms have been responsible for hundreds of millions of dollars in lost investments.

In addition to a reputable platform, you will need to find a staking contract that is reliable and provides a high payout ratio. Nansen’s DeFi Paradise Multichain is a great tool for this purpose, which displays all the staking contracts that are currently available in the market.

This dashboard can save you a lot of time and money by enabling you to quickly identify the highest paying staking contracts. It also shows you the risk/reward ratio of these contracts, so you can make an informed decision about whether or not to invest in them.

Choosing the right DeFi project to invest in can be challenging, as there are many projects competing for investors’ attention. Ideally, you should find one that has a high total value locked (TVL) and is growing rapidly in the crypto market. This is a good indicator of investor confidence in the platform and its core drivers.